Montreal filmmakers exposing Golden Dawn in 29 minutes

Article Image

Caption

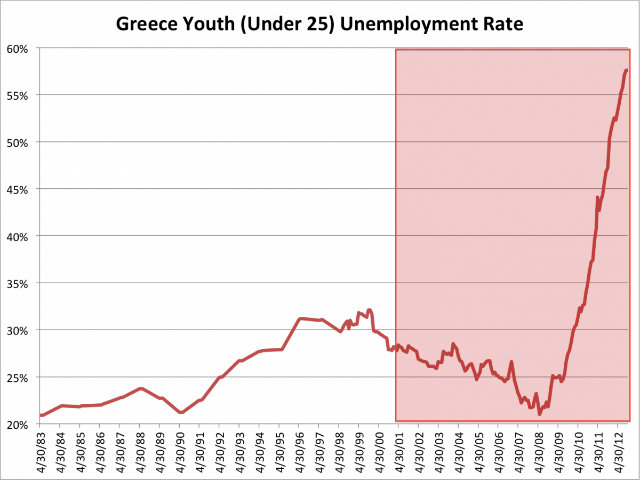

Peter James (L) and Philippos Balabanos (R) on the set of Dichotomous with members of the cast and crew

2013-04-01

Article Body

The actual filming of Dichotomous - an official selection at the 2013 Greek Film & Foto Week in Toronto next month - could be made into a documentary about two Greek Canadian filmmakers in Montreal determined to make it against all odds.

There was controversy: The film, which is about the rise of Greece’s right-wing anti-immigrant nationalist party Golden Dawn in North America, sparked plenty of debate. And there were a number of unpredictable twists and turns: After unsuccessfully seeking funding for the film on the crowdfunding site Indiegogo, the two Greek Canadian filmmakers, Philippos Balabanos and Peter James, struggled to complete the film on a very tight budget and even tighter shooting schedule. Cast and crew took a 100% pay cut.

The behind-the-scenes drama continued when the film was initially disqualified from the Greek Film & Foto Week because it was 14 minutes too long.

“In the end, everything worked out,” says Balabanos. “We waited to hear what the Greek America Foundation would decide to do with us.”

The Greek America Foundation decided to make Dichotomous one of its featured shorts for the Greek Film & Foto Week.

“Going into the shoot, I had a nagging feeling that we may have made too big of a film,” says Balabanos. “Peter had warned me there was no way we were going to do it, but I thought we had to go ahead and make the film. There was no way we could cut it to 15 minutes. We cut as much out without taking away from the story or the meaning of it. I think it was always meant to be a 29 minute story.”

Five locations, three days, one message

Dichotomous tells the story of Nick Dysmas (Peter James), a Greek Canadian photojournalist who has been covering the rise of the Golden Dawn in Greece. When he returns to his hometown of Montreal, he learns that Golden Dawn have opened a local branch. Through a twist of fate, his road converges with the local Golden Dawn leader known only as The Chief (Constantine Kourtidis) and the two find themselves on a path which tests their beliefs and endangers everything they hold dear.

It’s the first film short produced in Canada to address the growing popularity of Greece’s extreme (also described by critics as Neo-Nazi) Golden Dawn party among Greek expatriate communities.

James and Balabanos (photo, L-R) shot the film over three days at five locations across Montreal.

“As far as the actual making of the film, I have to say it was a weird experience,” says Balabanos. “It was just chaos. I wouldn’t call it fun, but it was satisfying.

“I hadn’t realized just how little people know about Golden Dawn’s origins,” he adds. “They only know what they hear on TV. They don’t know about Golden Dawn’s longterm goals, which is all on their website.”

Most members of the local Greek community are still very “hesitant” about the film, which is scheduled to premiere in Montreal on April 6 (see below for more details) . “People are supportive, but are keeping their distance,” says Balabanos. “I can understand this because Golden Dawn has ties with the Greek government and they are an official party.”

“We stuck to our story,” adds James. “We didn’t go to any extremes. We did not make this movie to - excuse my language - piss off Golden Dawn or anything like that. But we knew there would be some backlash... There were some rumblings from one of the local chapters [of Golden Dawn] when were making the film. Some people weren’t too happy.”

Both James and Balabanos say they are “very proud” of the film and hope that “it will speak to at least a few of the young minds which have been washed up into the terrifying phenomenon which is the Golden Dawn”. Even if it doesn’t, they say “it's a hell of ride with some great twists along the way".

Hope for Greece fundraiser

Balabanos and James have decided to dedicate the premiere screening of Dichotomous in Montreal (De Seve Theatre) on April 6 to the people of Greece.

A large part of the proceeds from the sale of the tickets will be donated to the Greek America Foundation’s Project Hope for Greece (a nationwide fundraising effort to support a range of charities and important institutions in Greece that are responding to the crisis in substantive and systematic ways and working to solve important problems for the people of Greece).

The April 6 screening is sponsored by PHOS films, carpe noctem pictures, the Hellenic Community of Greater Montreal and the Greek America Foundation.

Ten dollars of every $15 admission ticket sold will be donated to Project Hope. The rest will be used to cover the cost of the screening.

There was controversy: The film, which is about the rise of Greece’s right-wing anti-immigrant nationalist party Golden Dawn in North America, sparked plenty of debate. And there were a number of unpredictable twists and turns: After unsuccessfully seeking funding for the film on the crowdfunding site Indiegogo, the two Greek Canadian filmmakers, Philippos Balabanos and Peter James, struggled to complete the film on a very tight budget and even tighter shooting schedule. Cast and crew took a 100% pay cut.

The behind-the-scenes drama continued when the film was initially disqualified from the Greek Film & Foto Week because it was 14 minutes too long.

“In the end, everything worked out,” says Balabanos. “We waited to hear what the Greek America Foundation would decide to do with us.”

The Greek America Foundation decided to make Dichotomous one of its featured shorts for the Greek Film & Foto Week.

“Going into the shoot, I had a nagging feeling that we may have made too big of a film,” says Balabanos. “Peter had warned me there was no way we were going to do it, but I thought we had to go ahead and make the film. There was no way we could cut it to 15 minutes. We cut as much out without taking away from the story or the meaning of it. I think it was always meant to be a 29 minute story.”

Five locations, three days, one message

Dichotomous tells the story of Nick Dysmas (Peter James), a Greek Canadian photojournalist who has been covering the rise of the Golden Dawn in Greece. When he returns to his hometown of Montreal, he learns that Golden Dawn have opened a local branch. Through a twist of fate, his road converges with the local Golden Dawn leader known only as The Chief (Constantine Kourtidis) and the two find themselves on a path which tests their beliefs and endangers everything they hold dear.

It’s the first film short produced in Canada to address the growing popularity of Greece’s extreme (also described by critics as Neo-Nazi) Golden Dawn party among Greek expatriate communities.

James and Balabanos (photo, L-R) shot the film over three days at five locations across Montreal.

“As far as the actual making of the film, I have to say it was a weird experience,” says Balabanos. “It was just chaos. I wouldn’t call it fun, but it was satisfying.

“I hadn’t realized just how little people know about Golden Dawn’s origins,” he adds. “They only know what they hear on TV. They don’t know about Golden Dawn’s longterm goals, which is all on their website.”

Most members of the local Greek community are still very “hesitant” about the film, which is scheduled to premiere in Montreal on April 6 (see below for more details) . “People are supportive, but are keeping their distance,” says Balabanos. “I can understand this because Golden Dawn has ties with the Greek government and they are an official party.”

“We stuck to our story,” adds James. “We didn’t go to any extremes. We did not make this movie to - excuse my language - piss off Golden Dawn or anything like that. But we knew there would be some backlash... There were some rumblings from one of the local chapters [of Golden Dawn] when were making the film. Some people weren’t too happy.”

Both James and Balabanos say they are “very proud” of the film and hope that “it will speak to at least a few of the young minds which have been washed up into the terrifying phenomenon which is the Golden Dawn”. Even if it doesn’t, they say “it's a hell of ride with some great twists along the way".

Hope for Greece fundraiser

Balabanos and James have decided to dedicate the premiere screening of Dichotomous in Montreal (De Seve Theatre) on April 6 to the people of Greece.

A large part of the proceeds from the sale of the tickets will be donated to the Greek America Foundation’s Project Hope for Greece (a nationwide fundraising effort to support a range of charities and important institutions in Greece that are responding to the crisis in substantive and systematic ways and working to solve important problems for the people of Greece).

The April 6 screening is sponsored by PHOS films, carpe noctem pictures, the Hellenic Community of Greater Montreal and the Greek America Foundation.

Ten dollars of every $15 admission ticket sold will be donated to Project Hope. The rest will be used to cover the cost of the screening.